Whether you own a vacant lot, single-family home or a commercial building, you likely will pay property taxes. These types of taxes have been collected in the U.S. since early colonial days, and they are not going away. In the words of Benjamin Franklin…”Nothing is certain but death and taxes.”

Here’s some information to help you better understand property taxes.

What are Property Taxes?

A property tax is a tax that is imposed by a local government entity, like a county, city or town, on the value of property in its jurisdiction.

Unlike income or inheritance taxes that are connected to an individual person, property taxes are based on the value of the physical item at issue – the property. Because property taxes are based on value, they also are called ad valorem (or “according to value”) taxes.

There are several different kinds of property that are taxed, including both real estate and personal property (like vehicles). For this article we will focus on property taxes on land and improvements, also commonly referred to as real estate taxes.

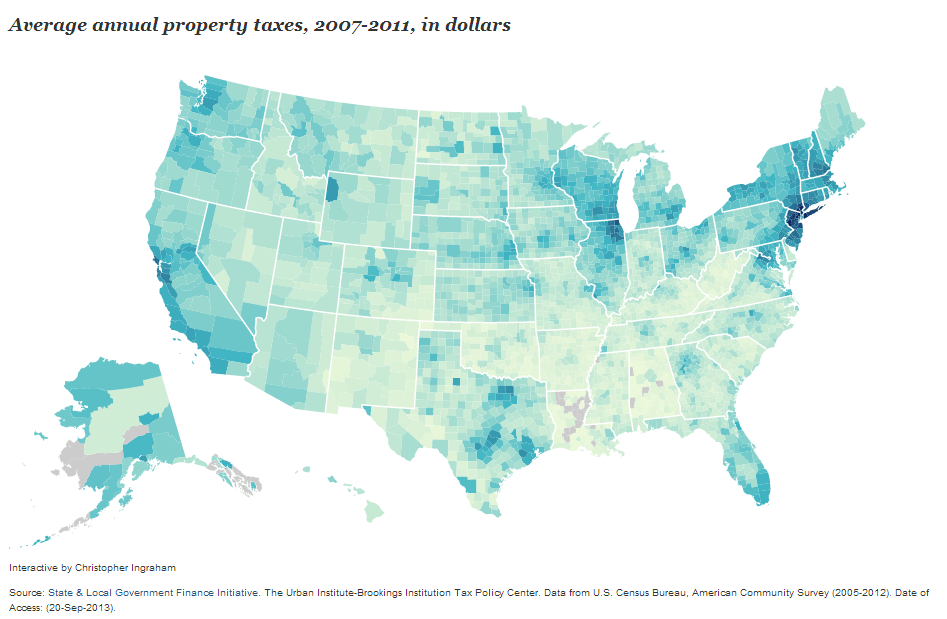

Property Taxes Across the Nation

Property taxes are the primary source of income for most local governments across the country. Your local government uses the real estate taxes that you pay for services like police protection, fire protection, sanitation, government programs, parks, roads and schools.

Your property’s location is ultimately what will determine your real estate taxes. Property tax rates may vary widely across a state, so the tax amount paid by citizens per thousand dollars of property value chiefly depends on where their property is located. Because real estate has a fixed location – you can’t move your land to a different county! – it usually is not difficult for you to determine the government entities that have the authority to tax your property and the rates that will apply.

Follow this link for an excellent interactive map that shows information about amounts paid by households for real estate taxes in counties across the nation. You can click on your county to find the average property tax paid, average home value and the tax amount as a percentage of home value. (Source: Urban Institute and Brookings Institution Tax Policy Center)

Who Imposes Property Taxes?

Many new land and homeowners wonder who really has the authority to decide the amount of their property taxes.

Although you typically will receive information about your property taxes from a local municipal body that is below the state level, the authorization to charge a property tax comes from the state. The governing body in the state where your property is located makes all applicable laws about how property taxes will be determined and collected by local taxing authorities across the state. Local governments set their rates and procedures according to this system.

Every situation is different, but most landowners and homeowners will make a real estate tax payment each year to their county. Although the county or parish often is the primary point of contact, some properties actually are taxed by multiple taxing authorities. Look closely at your tax bill and you may see that your taxes are not just being paid to the county, but also may include an amount for your city, town and even other taxing districts or boards. The county clerk, assessor office or other official tax collector is often the entity that collects and reallocates the property tax payments.

How are Property Taxes Determined?

As an ad valorem tax, property taxes are calculated based on the value of the property at a specific time. Typically, an assessor with your local taxing authority will determine how much your property is worth by looking at where the land is located, evaluating the size and conditions of the parcel, considering the value of any structures or improvements on the land and comparing it to other similar properties. The assessment is much like an appraisal, and helps the assessor try to determine the market value of the property for tax purposes as of a certain date.

As a property owner you should receive a tax bill or statement each year that details the assessed value, millage rate, tax payment due and other details. Property taxes usually are paid once a year and are based on this assessment of what the property is worth on a set date. If you own the property on the date used by the taxing authority, then you are the one who is responsible for its payment and will receive the official tax statement. Some property owners have escrow arrangements with their mortgage lenders where their annual property tax payment is processed and paid by their bank.

The property tax rate that applies to your property will be based on the criteria used by your local taxing authorities and is set by law. It can vary widely but will apply impartially across all properties of that type, though different rates may apply for different types of properties.

Many taxing authorities use a factor known as a millage rate. The millage rate is the amount of tax per thousand dollars of your property’s value. If your property is taxed by more than one taxing authority, each may have its own millage rate. In some areas the tax rate only is applied on a percentage of the property’s assessed value.

Generally the applicable property tax is calculated by multiplying its net assessed value (less any exemptions or deductions) by the millage rate divided by 1,000. So if a property with a $100,000 net assessed value was taxed at a millage rate of 15, you would have a tax bill of $1,500 per year ($100,000 x .015 = $1,500).

Revaluations & Appeals

Every few years taxing authorities undertake a revaluation that may increase or decrease the assessed value of your property and the resulting amount of your annual taxes. A revaluation usually is a large undertaking for the government, and can invoke a lot of passion and politics.

After a revaluation, you should receive a notice of the new valuation. You also will receive information about how to appeal if you believe the valuation is not correct. Because a higher assessed value for your property results in you paying a higher tax payment, you should carefully review your revaluation notice.

A revaluation is not the only way in which a property’s tax value may be increased. In some jurisdictions a new value may be applied to your property when a sale occurs. A new sale provides the government a generally reliable calculation of what the market really thinks the property is worth.

A revaluation is not the only way in which a property’s tax value may be increased. In some jurisdictions a new value may be applied to your property when a sale occurs. A new sale provides the government a generally reliable calculation of what the market really thinks the property is worth.

You may wish to consider appealing your tax assessment if the tax value for your property is set too high, whether because of a revaluation or just as a result of changing market conditions. If you can make a good argument as to why your tax value should be lowered (including evidence of comparable properties with lower assessed or market values), then consider initiating the local procedures for an appeal. Keep in mind that it is up to you to make an appeal if you believe you are being overcharged, so you need to keep an eye on your property’s assessed value to make sure it is not too high.

Assessed Value vs. Market Value

Be aware of the difference between assessed value and market value. We’ve already described how the assessed tax value is determined. In contrast, the market value is the amount that a third-party buyer would pay for a property in an arm’s length transaction under stable selling conditions.

The tax value rarely will match the actual market value for a property, and revaluations only are done every few years. As noted above, sometimes the assessed value is too high and you may wish to consider an appeal. However, in many areas the assessed tax value for a property may be far less than the property’s real market value. Don’t let a low tax value worry you as a property owner – just consider yourself fortunate to possibly be paying a more reasonable tax rate.

Appreciating the differences between assessed and market values can be helpful when you are buying or selling real estate.

Tax Exemptions and Deductions

Some people and organizations are eligible for property tax exemptions, deductions or incentives. Exemptions often are provided to charities, non-profits, government entities and religious institutions. In addition, certain uses or restrictions on a property may decrease its taxes, like land used for farming or preserved for conservation. Other deductions may exist that are based on the owner, like for seniors or veterans. Finally, tax breaks may be provided to businesses for economic development or business recruiting purposes.

How Do Property Taxes Really Affect Me?

As a home or landowner you have the responsibility to pay your property taxes. Do your research to understand what your taxes will be before you buy a property. If you already own the property, then going forward you should simply consider your property taxes as part of your annual budget.

The reality is that real estate taxes can have a big impact on property owners, especially when their property is vacant land that is neither producing revenue nor providing a roof over their head. Real estate taxes are “holding costs” that are major budget items for builders, developers and other property owners that are sitting on unsold or undeveloped property. And people who may have bought a lot before the downturn for a vacation or retirement home – and never built on it – know the pain of an annual property tax payment. The burden of property taxes is one of the most common reasons why landowners finally decide to sell their vacant lots or land.

What happens if I don’t pay my property taxes?

If you do not pay your taxes, the taxing authority has a number of ways to recover what is owed. A tax lien may be applied to your property, and your property could be sold at a public tax sale. A tax lien is a powerful instrument and in most cases creates a super-priority lien that jumps to first in line for being paid off. A tax lien can even jump in priority over your existing mortgage, which does not make lenders happy at all because it puts their mortgage at risk of being diminished in the foreclosure of a tax lien. Most mortgages protect the lender in this scenario, and your failure to pay real estate taxes may cause you to be in default under your mortgage. In addition, having a lien on your property can affect your ability to sell it.

What about real estate taxes when buying or selling a property?

In most areas, when a closing for the sale of a property occurs you “prorate” or proportionally allocate the amount of the current year’s taxes between the buyer and seller based on the number of days in the tax year that each will own the property. This proration is based on the most recent tax payment information, so the arrangement sometimes involves post-closing adjustments if the tax payment notice is received after the closing and indicates a significantly different tax payment is due.

This process may be handled differently based on local customs or contract negotiations.

What happens if I inherit a property and taxes are owed on it?

If you inherit land or other real estate you will be responsible for any property taxes that are owed on it that otherwise have not been paid out of the settlement of the estate.

As old Ben Franklin noted, taxes are not going away. Property taxes are just something you have to deal with as a property owner, but at least it helps to understand real estate taxes and how they affect you.

Be sure to share this article with others!

Related Resources:

- So You’ve Inherited Land…What’s Next? — lotnetwork.com

- 8 Tips for Buying Residential Lots or Land for a New Home — lotnetwork.com

- Tips and Resources for Selling Lots & Land — lotnetwork.com

- Tips and Resources for Buying Lots & Land — lotnetwork.com